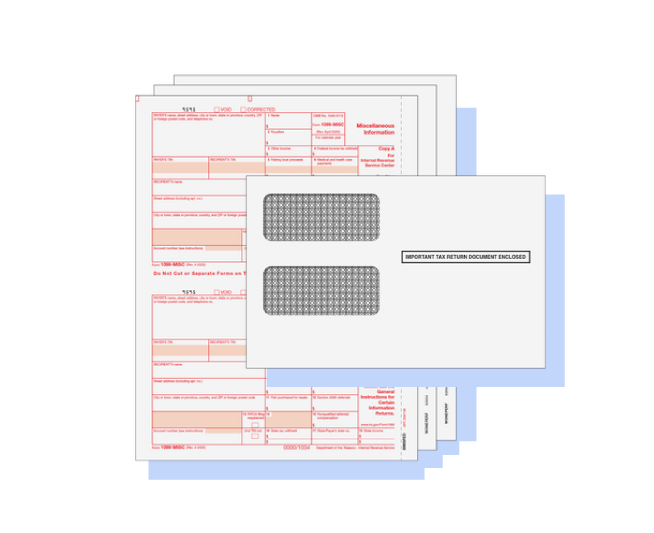

1099 Filing

Essential 1099 Filing Guidelines

If your business paid $600 or more for services performed by individuals who are not treated as employees, you may need to file Form 1099-MISC. This form is used to report miscellaneous income for independent contractors and other non-employee service providers.

The IRS requires Form 1099-MISC for common situations such as payments to freelancers, consultants, and vendors. Filing accurately helps your business stay compliant and avoid penalties.

E-File Threshold

The newly released IRS regulations have lowered the threshold for having to electronically file forms from 250 to 10 for this filing season. This new regulation includes the total for all aggregated forms filed.

Federal Transmittal

In addition to filing Form 1099-MISC to the IRS, you may be required to file a transmittal (cover sheet). If you are sending paper copies to the IRS you will need to include Form 1096. This transmittal is not required if you are filing electronically.

1099 Copies

If your business is required to file Form 1099, you must provide multiple copies. To avoid penalties, ensure each copy is sent to the correct recipient when applicable.

The IRS requires multiple copies of Form 1099 for different recipients and purposes. Each copy serves a specific role, such as reporting to the IRS, providing information to the payee, and meeting state or local requirements.

Copy A

Sent to IRS for official reporting.

Copy B

Provided to recipient payee.

Copy C

Retained by payer business for their records.

Copy 1

Sent to state tax department.

Copy 2

Provided to recipient payee for their state income tax return.

Do You Have the Products You Need This Filing Season?

Greatland Has Everything You Need for Fast, Easy, and Compliant Filing.