Below are the available bulk discount rates for each individual item when you purchase a certain amount

IMPORTANT: Beginning in filing year 2021, the IRS threshold for filing Form 1099-K will be lowered from $20,000 to $600. Learn more about e-filing at yearli.com

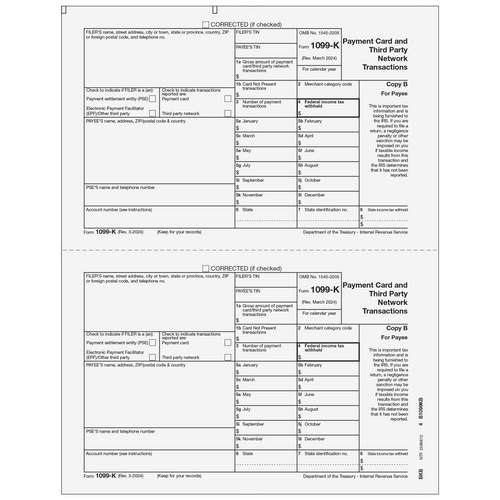

Payment Card and Third Party Network Transactions Use Form 1099-K Copy A to print and mail payment information to the IRS. 1099-K forms are printed in a 2-up format on 8 1/2" x 11" paper with 1/2" side perforation, and are printed on 20# laser paper. Mail as a batch to the IRS. Order by number of forms, not sheets.